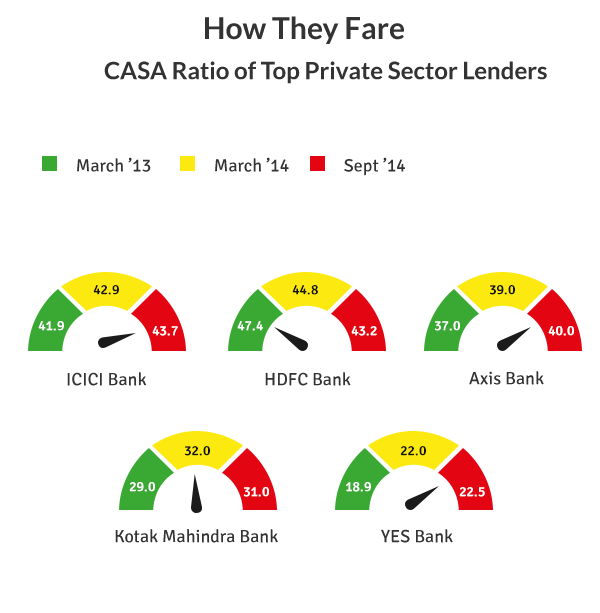

Imagine someone lends you money for peanuts (or) free for your business, feeling excited. Now rate that someone's investment acumen. Banks run the business by borrowing at lesser rate and lending at higher rate. In India Banks pay around 4% for SB accounts and No (0%) for Current Accounts. CASA ratio of a bank is the ratio of Deposits in current (CA) and saving (SB) accounts to total deposits.You may ask who will keep money in savings account. I am presenting CASA Data below in Pic.1 and 2

Current CASA numbers are no different, SB account constitutes more than 60% of CASA. Literally, our hard earned money works for banks not for us. Banks grow on our financial ill-literacy and ignorance. Doctors keep too much money idle; Financial Consultants for Doctors advise them to invest in appropriate instruments like Liquid Funds, Short Term Bond funds etc. In most cases the differential return itself can take care of their insurance premiums. It's not only about investment returns. You have to look at the Post-Tax yield. Benjamin Franklin said, "In this world nothing is said to be certain, except death and taxes", Add Inflation to this list. It's not important how much return it generates, how much you get at the end after the expenses and taxes matter. For example if you Deposit Rs. 1,00,000 in 1 year FD @ 8%, bank will pay 8,000 at the end of the year. But you are liable to pay tax on interest earned. If you are in highest tax bracket your net may be @ 5,100 (5.1%).You are owner of only net-yield.

Net Yield = Gross Return – (Expenses +Taxes)

Below table explains the Taxation effect:

SYes, you make positive return in fixed instruments, but you bleed because of a monster called Inflation (Loss of money value). Historical Inflation of India is around 6.5%. So any investment should give Positive Net Yield.

Fiduciary:

(Financial Planner will put your interest first and make you take informed decisions)

Recent Posts

- Aug 15,2018Complete Guide to Achieve Financial Freedom

- July 30,2018Personal Finance And Women

- July 23,2018How to Break Free of Debt and Build Wealth!

- July 12,201810 proven Steps to Financial Security Before 30

- June 29,2018How to teach your kids about the family finances?

- June 23,20187 Most Important Things to Consider before Investing

- June 09,2018Pitfalls of Real Estate Investment

- June 02,2018Financial Security of the Child in a remarriage

- May 25,2018Free Vs Paid Advisory

- Nov 09,2016Grave Financial Mistakes NRIs Make

- Nov 09,2016How Cost Matters to Get the Best Investment Returns

- Nov 09,2016Problems With Luxury Shopping Without Planning

- Nov 09,20166 Time Tested Money Management Tips New

- Nov 09,2016What matters while investing?

- Nov 09,2016Do you really need a Financial Plan?

- Nov 09,2016All about GST and it's Impact on you

- Nov 09,2016How to create your Advisor?

- Nov 09,2016Consequence of Intestate Inheritance