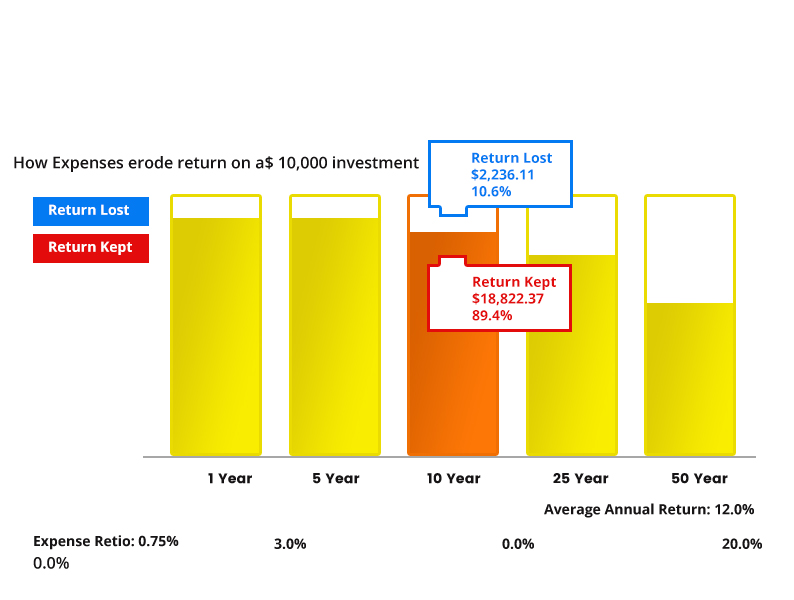

Ever wondered, why your actual return is not exactly same as scheme return? It's just because of cost. Investors can't control the markets or identify and invest on winning manager consistently to make higher returns than the average investor. But they can surely control what they pay to invest by choosing right assets and low cost options.This one thing can make a massive difference over time. The lower your costs, the greater your share of an investment's return, and the greater the potential impact of compounding.

General Cost of Investments

Cost of Entry Eg. Entry Load/Processing Fee/Set-up fee Recurring Cost Eg. Fund Management Fee/ Annual Fee/Maintenance Fee Exit Cost Eg. Exit Load/Penalty on pre-exit/

There are other costs also involved

Compounding impact of low cost is powerful tool for all investors alike. Don't pay for what you don't need. Fees and quality are not necessarily proportionate. It's proven that, in any given asset class, lower-cost investments have outperformed higher-cost alternatives. Classic example could be passive ETF Vs actively managed high cost PMS. Another one could be Unit Linked Insurance Plans (ULIPs) Vs Mutual funds. There is difference of about 0.75-1.0% between Regular plan Vs Direct plans in mutual funds.

Cost of behavioral Biases:

Decisions don't take place in vacuum. Every action and inactions cost. It's not unusual for investors to fight between analytical brains and emotions. We tend to behave differently on money matters caused by biases. Biases could negatively impact one's financial position. We can't eliminate biases. It's who we are. Taking steps to minimize biases or keep them in check is critical to financial success. Some of the common biases which play havoc are.

Confirmation Bias:People often look for information or ideas that validate existing beliefs and opinions and satisfy themselves. The best way to overcome this bias is to consider information from multiple sources.

Mental Accounting:People treat various sources of money as being different from others.This can affect the way the money is spent or invested. E.g. Money earned by salary treated differently than money received as gift/inheritance.

Regency Bias:Investors' believe what's happened recently will continue to happen.

Herd Mentality:influenced by their peers and general masses to follow trends, purchase items and adopt certain behaviors, even if it is not in your best interest. Classic example - Many people buy when the market is high and sell when the market is down (stocks available at a highly lucrative valuation)

Hindsight bias:People tend to overestimate the accuracy of their predictions and get a false sense when making investment decisions, which can lead to excessive risk-taking behavior and disastrous to his portfolio.

Loss-Aversion Bias:People often feel the pain of loss more than the joy of gains. They afraid book loses and reinvest in well managed fund/asset and become a long term investor.

Endowment / Status-Quo Bias:once you own something you start to place a higher value on it than others would. This is kind of loss aversion.

Gamblers' Fallacy:"Guess What?"

Cost of Ignorance

NRI's tend to invest heavily in physical assets like real estate and gold. There are no or lesser financial assets to fall back on. Real estates are highly ill-liquid and tax inefficient. Ask yourself, are you still getting those assured and lucrative rental incomes? Why always invest in a lump sum when you visit India? Start some recurring investments in financial assets as well. Remember any asset class is cyclical Don't understand between investments and insurance deposit in bank at lower single digit return and borrow at double digit interest rate Buy jewels for investments (@ 15% extra charges and rotates once in a while) Not aware of risks involved. Not aware of cost involved and potential conflict of interest. Underestimate Inflation and tax effect. There are other costs also involved like, Cost of currency conversion, Management fees and Taxes

Recent Posts

- Aug 15,2018Complete Guide to Achieve Financial Freedom

- July 30,2018Personal Finance And Women

- July 23,2018How to Break Free of Debt and Build Wealth!

- July 12,201810 proven Steps to Financial Security Before 30

- June 29,2018How to teach your kids about the family finances?

- June 23,20187 Most Important Things to Consider before Investing

- June 09,2018Pitfalls of Real Estate Investment

- June 02,2018Financial Security of the Child in a remarriage

- May 25,2018Free Vs Paid Advisory

- Nov 09,2016Grave Financial Mistakes NRIs Make

- Nov 09,2016How Cost Matters to Get the Best Investment Returns

- Nov 09,2016Problems With Luxury Shopping Without Planning

- Nov 09,20166 Time Tested Money Management Tips New

- Nov 09,2016What matters while investing?

- Nov 09,2016Do you really need a Financial Plan?

- Nov 09,2016All about GST and it's Impact on you

- Nov 09,2016How to create your Advisor?

- Nov 09,2016Consequence of Intestate Inheritance